China’s 10-year sovereign yield slumped to a fresh record low Monday, as a string of sluggish economic data boosted demand for haven assets https://t.co/iXurrltF0v

— Bloomberg Markets (@markets) December 16, 2024

China’s short-term bond yields fall below 1% https://t.co/pXk5H3o2y5

— Financial Times (@FT) December 20, 2024

Hong Kong, China's pivotal hub for international finance, could become a casualty if US-China tensions rise as expected under Donald Trump https://t.co/mM18WPX8uA

— Bloomberg Economics (@economics) December 21, 2024

Trump's goal with China should be to "avoid a massive trade confrontation," says @RichardHaass of @CFR_org. Learn more about what issues lie ahead on tonight's "Wall Street Week" with @DavidWestin. Tune in at 6 p.m. ET https://t.co/AAojHi6PGy pic.twitter.com/CCKjBH1O2M

— Bloomberg TV (@BloombergTV) December 20, 2024

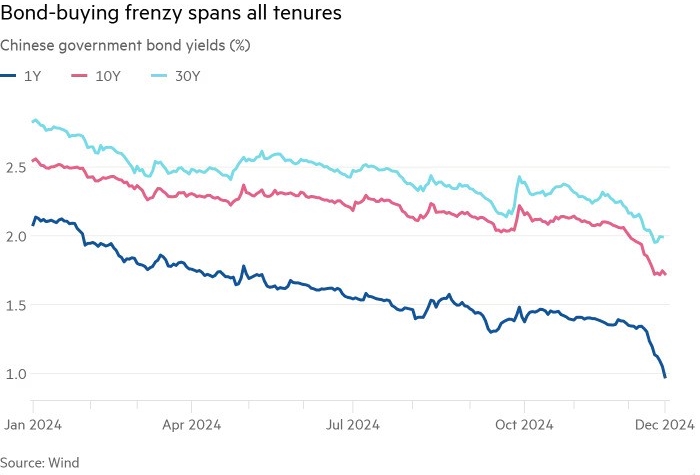

알면 알 수록 놀라운 '주댕이'의 민낯이 드러나고 있는 '윤석열'이 모의재판에서 '사형'을 '구형'했다는 "전두환 판례"대로면 '무기징역'에 해당되는 '내란 수괴'가 12.3 불법 비상계엄을 선포한 당일 중국의 10년물 국채금리가 사상최초로 2%를 하향 돌파를 한데 이어, 불과 20일 만에 1년물 국채금리가 2009년 이후 최저치를 경신하며 1% 이하인 0.92%로 붕괴가 됐고, 10년물 국채금리는 0.03%p 추가 하락하여 1.74%로 최저치를 경신했습니다.

Beijing’s mayor calls on AstraZeneca to expand its research and development investment in the Chinese capital, signaling that a probe against some of its executives won’t affect business ties with the UK drugmaker https://t.co/hGJloGn2Z6

— Bloomberg Economics (@economics) December 20, 2024

UK Chancellor Rachel Reeves will travel to China during the second week of January to revive high-level discussions aimed at improving economic ties between the countries https://t.co/dtczco19Tw

— Bloomberg Economics (@economics) December 20, 2024

BOE Governor Andrew Bailey will accompany Britain’s Finance Minister Rachel Reeves on her official visit to China in January, Sky News reported https://t.co/mL6QtM93pq

— Bloomberg Economics (@economics) December 21, 2024

China has room to further reduce the reserve requirement ratio from the current average level of 6.6%, the 21st Century Business Herald reported, citing Wang Xin, director of the research bureau under the People’s Bank of China. https://t.co/ILjO3TQMFc

— Bloomberg Asia (@BloombergAsia) December 14, 2024

중국의 단기 국채 수익률은 내수 약세에 대한 우려로 중앙은행이 통화 정책을 추가로 완화할 것이라는 베팅이 강화되면서 글로벌 금융 위기 당시 마지막으로 보였던 수준으로 떨어졌습니다. 1년 만기 채권 수익률은 0.92%로 2009년 이후 최저 수준을 기록했으며, 10년 만기 채권 수익률은 이달 초 2%를 돌파한 후 0.03%p 하락한 1.74%를 기록했습니다.

China’s housing regulator is seeing signs of stabilization and improved sentiment in the real estate market as a result of government stimulus measures, China News Service reported. https://t.co/db18VEebos

— Bloomberg Economics (@economics) December 15, 2024

China's property debt crisis is entering its fifth year, with developers still struggling to repay debt amid a slump in home sales https://t.co/2zW4rvxwnt

— Bloomberg Economics (@economics) December 22, 2024

China's richest cities were once seemingly slowdown-proof. Now, they're struggling to save the nation's economy https://t.co/MSCjqMeTRk

— Bloomberg Economics (@economics) December 22, 2024

Retailer At Home is shifting some of its manufacturing and product supply lines away from China in an effort to minimize the impact of tariff’s on US imports that President-elect Donald Trump has threatened to impose on Beijing https://t.co/w5ttXHPSSD

— Bloomberg Asia (@BloombergAsia) December 20, 2024

채권 수익률은 가격과 반대 방향으로 움직입니다. 수익률 하락은 중국 '인민은행'(PBOC)이 1년 및 5년 만기 대출 우대금리(LPR)를 동결한다고 발표하면서 2025년 추가 금리인하에 대한 시장의 기대감이 강화된 이후 나온 것입니다. PBOC가 주요 정책 수단으로 간주하는 7일 역레포 금리는 현재 1.5%입니다.

Economists believe the latest signals from China’s top leaders show their determination to revive the economy and market confidence: Here’s your Evening Briefing https://t.co/B0gn0sCKjE

— Bloomberg Economics (@economics) December 14, 2024

China’s economy likely maintained momentum last month, with early indicators pointing to further stabilization as a broad package of stimulus measures took effect https://t.co/USezO9qMZ1

— Bloomberg Economics (@economics) December 15, 2024

금리인하 기대감을 탄 채권 매수 열풍은 지난달 수입이 예상보다 많이 감소하면서 내수 약세에 대한 우려가 커지고 있는 가운데, 11월 소매 판매 데이터도 '전망치'에 미치지 못한 데 따른 것입니다.

Advanced Micro-Fabrication Equipment has been removed from the US Department of Defense’s list of Chinese military companies, doing away with what the firm described as an “irrational” designation https://t.co/urCtYmCSXE

— Bloomberg Technology (@technology) December 18, 2024

China’s exports of lithium-ion batteries to the US spiked to a record last month as companies raced to ship products before the government removed tax benefits. https://t.co/ECKNtftxQ0

— Bloomberg Asia (@BloombergAsia) December 20, 2024

While China's supply chain grows, so too does its brands' global influence.https://t.co/hBk6tc9r2S pic.twitter.com/90r8537GqO

— Nikkei Asia (@NikkeiAsia) December 20, 2024

In China, factory managers debate how to face Trump tariffs — and there's no good option https://t.co/Zk6rOgvTBe

— Bloomberg Economics (@economics) December 22, 2024

그러나 BNP Paribas 자산운용의 포트폴리오 매니저인 Wei Li 최근 경제 데이터에 따르면 국내 소비는 여전히 부양이 필요하지만 "최근 경기 부양책이 효과를 발휘하기 시작했다"면서 "연말 은행과 보험사의 국채 수요 증가도 수익률 하락에 기여했습니다."라고 말했습니다.

Lululemon's investment into China stores is "paying off," according to this analyst: pic.twitter.com/l0unbWGXZc

— Yahoo Finance (@YahooFinance) December 12, 2024

Pop Mart has become the hottest Chinese growth company, with shares up 368% this year, and is also beating global peers like Disney and Sanrio. The secret: collectible dolls. https://t.co/q5dm7iXL4r

— Bloomberg Technology (@technology) December 20, 2024

Hong Kong’s flailing commercial property market is getting a lift from the education sector as the number of Chinese students surges in the city https://t.co/l56XbIuG9I

— Bloomberg (@business) December 18, 2024

Conference Board survey of top executives finds that their confidence in China has dropped for the first time since the coronavirus pandemic https://t.co/gjlZrU0WND

— Bloomberg Economics (@economics) December 21, 2024

지난주 중국은 14년 만에 처음으로 통화정책 기조를 '완화'했습니다. 중국은 내년에도 경제와 내수를 '부양'하겠다는 의지를 계속 표명하며 시장의 충분한 유동성을 확보하기 위해 은행의 지급준비율과 금리를 인하하겠다고 약속했습니다.

China's President Xi Jinping said Macau should ‘keep up with the trend of the times’ and play a bigger role on the international stage, as he urged the world's biggest gambling hub to never be complacent and show ‘courage’ to change and innovate https://t.co/PpV9nySz9J

— Reuters (@Reuters) December 20, 2024

China's 'erotic clothing' capital is bracing for Trump's pledge to raise tariffs and a crackdown on e-commerce exporters. How such firms deal with the looming setback is crucial for residents of Guanyun https://t.co/nbwq4cHBlU

— Reuters (@Reuters) December 16, 2024

China will expand its private pension program to the entire country, as the government grapples with retirement payout challenges due to the rapidly aging population https://t.co/qgMpqrGGCs

— Bloomberg Asia (@BloombergAsia) December 12, 2024

많은 분석가들은 중국 채권 시장을 중국 경제 성장에 대한 기대감의 도박판(battleground)으로 보고 있으며, 정책 입안자들은 채권 수익률 하락을 따른 시장의 기대감을 경제에 대한 부정적인 신호로 보고 있습니다.

수익률 하락에 기여하고 있는 국내 금융기관이 국채에 투자하는 것을 피난처로 삼으려는 '최근 시도'에서 PBOC는 수요일 국채의 '공격적인' 거래를 한 것으로 판단되는 일부 은행을 소환했습니다.

중앙은행은 금리 위험에 유의하고 채권에 대한 "묻지마" 투자 행동을 취하라고 경고했습니다. 또한 PBOC 계열 매체인 Financial News에 따르면 채권 시장의 불법 활동에 대한 "무관용"을 재차 강조했습니다.

Calligraphy has for two millennia been considered the highest form of art in China.

— The Economist (@TheEconomist) December 21, 2024

Now Xi Jinping has transformed it into a cultural practice that conforms to and boosts the version of the country’s history promoted by the Chinese Communist Partyhttps://t.co/YkE5ZDWF0S

China signaled further stimulus measures including raising its budget deficit in 2025 at a key economic meeting that sets policy priorities for the coming year https://t.co/VulYumE1H8

— Bloomberg Markets (@markets) December 12, 2024

실리콘밸리의 은행 사태와 유사한 '위험'에 대한 올해 초 경고보다 더 많이 측정된 '합법적' 투자 활동입니다. 국내 투자 옵션이 제한된 소규모 중국 은행들이 상대적으로 안전한 자산에 투자하면서 모든 만기의 중국 국채 수익률이 연초 이후 하락세를 보이고 있습니다. 10년물은 연초에 2.56%의 수익률을 기록했고, 30년물2.84%의 수익률을 기록했습니다.

The Bank of Russia holds its key interest rate at a record-high 21%, surprising most analysts who’d expected policymakers to opt for another big hike to try to tame persistent inflation https://t.co/94d8l9Ji9l

— Bloomberg (@business) December 20, 2024

Russian factory activity expands marginally in November, PMI shows https://t.co/oUT53y0LGU pic.twitter.com/df4MaOXDe5

— Reuters (@Reuters) December 2, 2024

An exchange rate of 100 to 110 rubles per US dollar is “reasonable” as it balances the interests of the state and exporters, according to Russia’s richest man Vladimir Potanin https://t.co/ZdNde5GwTf

— Bloomberg Economics (@economics) December 14, 2024

Nabiullina faces rising criticism within the Russian political and business elite https://t.co/31oQOzR5oD

— Bloomberg Politics (@bpolitics) December 19, 2024

2023년 중반에 기준금리를 7.5%까지 점진적으로 인하했던 러시아 중앙은행은 경제학자들이 예상한 23% 인상과 달리 기준금리를 '21%'로 동결했습니다. 이번 결정은 2022년 초 우크라이나 전면 침공 이후 가장 높은 수준을 유지하는 것입니다.

Europe Gas Prices Jump as EU Signals No Interest in Russia Flows https://t.co/KBiJRSnxsA

— Bloomberg Economics (@economics) December 17, 2024

With less than two weeks left until a transit deal between Russia and Ukraine expires, Europe’s natural gas market is getting ready for turbulent trading after the New Year break https://t.co/Y2nSezubbu

— Bloomberg Asia (@BloombergAsia) December 20, 2024

Can Liking Russia Get You a Gas Deal? https://t.co/ZTYkShrLZY

— Bloomberg Energy (@BloombergNRG) December 20, 2024

중앙은행은 블라디미르 푸틴의 우크라이나 침공을 지원하기 위한 자원과 인력 재분배로 인한 인플레이션 급등에 대응하면서 이러한 조치를 취했습니다. 엘비라 나비울리나 총재는 "대출이 현저히 둔화되고 있음을 확인하고 있다"면서 예상보다 빠른 신용 수요 감소를 이번 결정의 이유로 들었습니다.

Russia's seaborne crude exports have stabilized near 3 million barrels a day, down more than one-tenth in the past two months, writes @JLeeEnergy https://t.co/klqOCROXDs

— Bloomberg Middle East (@middleeast) December 17, 2024

The UK announces fresh sanctions targeting alleged "lynchpins" that enable the trade of Russian oil, along with 20 "shadow fleet" vessels https://t.co/UBUheZcSWR

— Bloomberg Economics (@economics) December 17, 2024

The European Union should consider taking bolder steps such as confiscating frozen Russian central bank assets to compensate Ukraine, the bloc’s top economic official said, downplaying risk warnings from the European Central Bank. https://t.co/uFvqLvjAmb

— Bloomberg (@business) December 20, 2024

Russia is poised for another aggressive rate hike on Friday as the central bank continues to find little success in tackling inflation that has recently accelerated well above its forecast https://t.co/nUWZr70zeQ

— Bloomberg Economics (@economics) December 20, 2024

Peace on Vladimir Putin’s terms would be a disaster for Ukraine and a disaster for Europe. @shashj explains what the Russian president wants https://t.co/rf4ePi3R4h pic.twitter.com/njnjw2zl7P

— The Economist (@TheEconomist) December 22, 2024

나비울리나 총재는 인플레이션이 계속 상승할 경우 2월 회의를 포함해 향후 금리 인상 가능성을 배제하지 않았습니다. 11월 소비자 물가는 전년 동월 대비 8.9% 상승했는데, 이는 전월보다 크게 증가한 것이며 중앙은행의 목표인 4%를 크게 상회하는 수준입니다. 푸틴이 2025년 군사비 지출을 늘릴 계획이어서 가까운 미래에 인플레이션 압력이 완화될 가능성은 '낮아' 보입니다.

Former Syrian President Bashar al-Assad said that he continued his duties until the early hours of Dec. 8, leaving for Russia only after it became clear that all battle lines had fallen https://t.co/rMgUw7qYB4 pic.twitter.com/5anelbOp5I

— Reuters (@Reuters) December 17, 2024

The prime minister of Libya’s internationally recognized government said he wouldn’t accept that Russian weapons be moved from Syria to the divided North African nation, Sky News Arabia reported https://t.co/DqTrBd5vYk

— Bloomberg Economics (@economics) December 19, 2024

The departure of Russia’s military from Syria should be a precondition for lifting EU sanctions against the rebel group that took power in Damascus, according to the Dutch foreign minister https://t.co/XhSP74UOB2

— Bloomberg Economics (@economics) December 16, 2024

2015년 말 '러시아'가 처음 '시리아'에 모습을 드러내면서 '시리아'의 바샤르 '알 아사드' 정권은 러시아 군의 무력을 바탕으로 9년간 더 정권을 연명할 수 있었습니다. '시리아'에서는 금지된 조직인 이슬람국가(IS)에 대한 승리는 크렘린궁의 주요 외교 정책적 승리로 선전됐습니다.

“Russia has been flying a Zeppelin along the border with a big Z painted on it.”

— The Economist (@TheEconomist) December 19, 2024

Today on “The Intelligence” we report from Estonia’s border with Russia https://t.co/dTff9FkLa9 🎧

Why thousands of North Koreans are fighting in Russia. Here are all your questions answered. https://t.co/8eHij78Q8l

— Bloomberg Middle East (@middleeast) December 18, 2024

A massive attack by Russian hackers on Thursday caused a temporary halt in the operation of state registries run by Ukraine’s Justice Ministry https://t.co/inIbkry4UC

— Bloomberg Technology (@technology) December 20, 2024

A carefully managed continuation of Russia's war against Ukraine benefits China in asserting its global leadership. https://t.co/fICot47EB0

— The Diplomat (@Diplomat_APAC) December 17, 2024

그러나 '우크라이나' 전쟁에 모든 자원을 쏟아부은 지금, 러시아는 '시리아' 혹은 '알 아사드' 대통령에게 신경 쓸 시간이 없었고 그 결과, 하야트타흐리트알샴(HTS)가 이끄는 반정부 세력은 10일 만에 수도 다마스쿠스를 점령하며 정권을 무너뜨렸습니다.

Trump says he wants to keep TikTok around ‘for a little while’ https://t.co/3YAuvRguhn

— TechCrunch (@TechCrunch) December 22, 2024

뭘 처 '읽었는지' '의문'인 '달러'를 마구 찍어 쓰겠다고 부채한도 상한 폐지를 요구했던 '트럼프'의 '셧다운 도박'이 실패로 끝난 이유는 재무부 재정적자뿐만 아니라 작은 정부를 지향하는 공화당의 보수 정치 패러다임과 맞지가 않았습니다. 일론 머스크가 "★'퇴출'★을 시키겠다."는 정치가 직업인 공화당 내 프로들이 그렇게 호락할 리도 없죠. 2024년 12월의 '정부 셧다운 결전'은 트럼프의 의회 내 공화당 의원들에 대한 '영향력'을 확인하는 첫 번째 큰 시험대였습니다.

The Reform leader and the technology billionaire met at Donald Trump's Mar-a-Lago residence in Florida on Monday. https://t.co/9ciunJoYis pic.twitter.com/4TTdy8FKxc

— Financial Times (@FT) December 18, 2024

영국에서 중국 '통일전선공작부'의 '간첩'들이 논란입니다. 2위 비야디(BYD, 16.8%)와 글로벌 전기차 배터리 시장 '점유율' 합산 53.6%의 1위 닝더스다이(CATL, 36.8%)와 공급 계약을 맺은 바 있는 '테슬라'(TSLA) 일론 머스크는 영국의 표퓰리스트 정당인 영국개혁당 '나이절 패라지' 대표에 기부를 한다고 말하였습니다.

London is struggling to attract listings on its stock exchange. Is Shein the answer? It's a tricky one for the Labour government. Get the Readout with @PronouncedAlva https://t.co/CoDu8MIiGt

— Bloomberg Middle East (@middleeast) December 11, 2024

UK consumers set to refrain from big Christmas buys, survey shows https://t.co/tHIj2KLPvF via @irinaanghel12 pic.twitter.com/DSaPIf5n1v

— Zoe Schneeweiss (@ZSchneeweiss) December 13, 2024

As French company Canal+ lists in London, there is a rare bit of good news for the beleaguered stock exchange. Get The Readout with @AllegraStratton https://t.co/PYeaZ7gRhr

— Bloomberg Economics (@economics) December 16, 2024

Private commodity financier Kimura is closing its London-based lending business, the latest exit from a sector that has witnessed a flight of capital in recent years https://t.co/CcCfIDSQkb

— Bloomberg Economics (@economics) December 17, 2024

88 companies have delisted or transferred their primary listing from London this year with only 18 taking their place.

— Marianna Giusti (@mauipippa) December 16, 2024

This marks the biggest net outflow of companies from the main market since 2009, with new listings also on course to hit 15 year low https://t.co/XFTE6rpVYY

UK retail sales grew more slowly than expected in November as cost-of-living pressures weighed on consumer sentiment in the wake of the Labour government’s first budget https://t.co/gPPbkKiB7O

— Bloomberg UK (@BloombergUK) December 20, 2024

영국의 '민간 소비'는 10월 0.7% 감소에서 소폭 상승세를 나타냈으나 느린 회복세에 대한 우려는 커졌습니다. 영국 통계청(ONS)은 11월 소매판매가 전월 대비 시장 예상치 0.5%를 하회한 전월 대비 0.2% 증가했다고 발표했습니다. 전년동기대비로는 10월 2.0%와 예상치 0.8%를 대폭 하회하며 0.5%로 집계됐습니다.

Britain's private-sector firms cut jobs at the fastest pace since the global financial crisis, outside the pandemic https://t.co/Dmdd0tDvBe

— Bloomberg UK (@BloombergUK) December 16, 2024

UK economy unexpectedly shrinks at the start of the 4th quarter https://t.co/vbFEDsf53j via @tomelleryrees @irinaanghel12 @PhilAldrick pic.twitter.com/Md5hdsr2D5

— Zoe Schneeweiss (@ZSchneeweiss) December 13, 2024

The latest surveys of manufacturing and services activity in the UK point to a worrying decline in hiring activity, as Rachel Reeves' private sector austerity budget starts to bite. What does it mean for the economic outlook in 2025? https://t.co/OjgRhvvjh4

— Bloomberg Asia (@BloombergAsia) December 16, 2024

Executives from companies including Rolls-Royce and Prudential will advise Prime Minister Keir Starmer’s government as it devises a new industrial strategy to drive growth in the UK https://t.co/DbGuHGq72u

— Bloomberg UK (@BloombergUK) December 17, 2024

UK businesses have shed almost 200,000 jobs this year, tax data show, suggesting the labor market is already unraveling in a warning sign for both Keir Starmer and the BOE https://t.co/qhvzAGdw2c

— Bloomberg Economics (@economics) December 17, 2024

UK private sector activity is set for a “steep” decline in the next three months, the Confederation of British Industry said https://t.co/2V9bYcmjG3

— Bloomberg Economics (@economics) December 23, 2024

앤드류 베일리 총재가 '영란은행'(Bank of England, BoE) 보고서에서 '침체된 성장'과 끈적한 인플레이션에 따른 "점진적"이라는 표현을 '강조'했던 BOE는 '예상'데로 기준금리를 ★'4.75%'로 동결★했습니다. 이번 동결 결정은 최근 2개월 연속 물가상승률이 연 2.6%를 나타낸 게 원인이라는 '분석'이 나옵니다.

The UK energy price cap is forecast to rise for a third consecutive time in April, the latest setback in the government’s attempt to lower bills https://t.co/w6V582yHwf

— Bloomberg Economics (@economics) December 14, 2024

UK businesses are seeking greater involvement in formulating trade policy, as the protectionism advocated by US President-elect Donald Trump plunges exporters into uncertainty https://t.co/kjg9O7ANlh

— Bloomberg Economics (@economics) December 15, 2024

Top law firms from New York, London and Chicago are deepening their presence in the Gulf, chasing profits from a region that’s announced more than $150 billion in deals this year https://t.co/9lhnnhBhXz

— Bloomberg Markets (@markets) December 16, 2024

UK inflation may not be as high as the official data shows, after academics found that volatile energy costs are making it difficult to get a clear picture of price rises https://t.co/IAnBbbiDbk

— Bloomberg Asia (@BloombergAsia) December 16, 2024

영국의 CPI는 전년동기대비 10월 2.3%에서 11월 2.6%로 상승했습니다. 영국은 최근 자동차 '연료 가격'과 의류비 등의 영향으로 물가가 상승했습니다. '식품'과 '에너지'를 제외한 근원 CPI도 10월 3.3%에서 11월 3.5%로 상승했습니다.

Investors are no longer fully pricing two quarter-point interest-rate cuts from the Bank of England next year https://t.co/W8TTRPm1Vz

— Bloomberg Economics (@economics) December 18, 2024

Investors pare bets on further rate cuts from the Bank of England, with the market assigning just a 50% chance of a quarter-point cut in February https://t.co/8s8SCdDmuw

— Bloomberg Economics (@economics) December 19, 2024

A Bank of England survey found that upcoming recycling regulations will cost some companies as much as Labour’s payroll tax hike and could result in higher prices https://t.co/nXMulXwHwM

— Bloomberg Energy (@BloombergNRG) December 19, 2024

Long-term UK government borrowing costs are approaching the highest level since 1998 as investors struggle to work out how much the Bank of England will cut interest rates next year https://t.co/TDtwS63iJc

— Bloomberg Economics (@economics) December 20, 2024

Might be about to be the worst quarter century ever for UK equities.. Last time it was this bad there'd been "a world war, a pandemic, and a mini depression after WWI that saw GDP fall more than -20% from peak-to-trough" say Deutsche Bank.. pic.twitter.com/4gXIaZGht0

— Merryn Somerset Webb (@MerrynSW) December 19, 2024

슈퍼코어 CPI('식품', '에너지'와 '주거비'를 제외한 근원 서비스 물가)는 전달과 같은 5%를 기록했습니다. '트럼프' 복귀가 D-28일 앞으로 다가온 가운데, 2025년 BEO 금리 어떻게 될 까요? '1초 컷'이죠.

Small homes in London are pouring onto the market as sellers try to get ahead of an upcoming tax increase, threatening to dampen demand for property for much of next year, according to Rightmove https://t.co/1O57YEoroG

— Bloomberg UK (@BloombergUK) December 16, 2024

Rents in London are soaring at the fastest pace on record after a resurgence that deepens the crisis facing the city’s tenants https://t.co/SiIwDn6duD

— Bloomberg Economics (@economics) December 22, 2024

The City of London Corporation approves a plan to build the financial district’s new tallest skyscraper https://t.co/N6D2zCNJhS

— Bloomberg CityLab (@CityLab) December 16, 2024

UK 'doesn't have enough builders' for Labour's 1.5m homes, industry leaders warn https://t.co/oMDR6Y13Fg

— BBC Politics (@BBCPolitics) December 14, 2024

BO는 보도자료를 통해 금리 결정 위원 중 대다수는 최근 '임금 상승률'과 물가 상승률로 인해 지속적인 인플레이션에 대한 리스크가 높아졌다고 '평가'했습니다.

Why UK private sector train operators are in no hurry to step down from driver’s cab https://t.co/7z2YEtyf0O | opinion

— Financial Times (@FT) December 13, 2024

Wage growth rises more than expected, while the regulator clears Carlsberg's takeover of Britvic and Thames Water faces a crucial day -- get briefed ahead of your morning calls with The London Rush https://t.co/54q7GKP0cl

— Bloomberg Economics (@economics) December 17, 2024

Bank of England Governor Andrew Bailey says market bets putting its next interest-rate decision on a knife-edge are a "reasonable starting point" https://t.co/TovOaqgBJ9

— Bloomberg Economics (@economics) December 19, 2024

Bank of England won’t let data ‘noise’ knock it from easing path https://t.co/56wwteuGiV via @PhilAldrick pic.twitter.com/G19f1KZhMp

— Zoe Schneeweiss (@ZSchneeweiss) December 19, 2024

UK stock bulls await vindication in 2025 as an enticing discount and large shareholder payouts are set to lift the market https://t.co/zb2gC8vysY

— Bloomberg Economics (@economics) December 19, 2024

BOE는 "남아 있는 인플레이션 압력은 더 느리게 해소되고 있다. 과거 인플레이션을 끌어올린 전 세계 '충격'이 어떻게 해소될지, 그리고 그에 따라 인플레이션 '압박'이 얼마나 지속될지 계속 고려하고 있다"고 전해졌습니다.

▲'역시' '정치'가 '후지면' 국민이 굶는다. '영웅', '채권'과 '달러' 투자의 '정석'(定石)으로 '금리', 산업, 고용, 소매, '주택'과 '부채' 재앙이 된 ★'트럼프'★ '미국'판 김건희 '일론 머스크' '탄핵' 운동 중입니다.▲

▲ 언론과 표현의 자유를 "입틀막"하고 블로그에 '글 썼다'고 '형사기소'한 '미국'과 '한국'에서 '핵무장'과 '증시 논란'의 '국정농단' '김건희' "오빠" '윤로남불'('구속 사유') 12.3 '내란 수괴' ★'윤석열'★ '감옥' 운동 중입니다.▲

▲ '블로그'의 모든 글은 저작권법의 보호를 받습니다. 어떠한 '상업적인 이용'도 허가하지 않으며, 이용('불펌') 허락을 하지 '않습니다'.

▲ 사전협의 없이 본 콘텐츠 무단 도용, 전재 및 복제, 배포를 금합니다. 이를 어길 시 '민, 형사상' '책임'을 질 수 있습니다.

'Honest First' 카테고리의 다른 글

| 윤석열 때문에 보수 폐족 면할 길 없어 (78) | 2024.12.25 |

|---|---|

| 트럼프發 장·단기 금리·환율 (96) | 2024.12.25 |

| 미국판 김건희 일론 머스크, 한국판 윤석열 트럼프 조합 괜찮나? (88) | 2024.12.24 |

| 정신 나간 윤석열과 국민의힘 때문에 한국 경제 답이 없다 (84) | 2024.12.24 |

| 선거 사기꾼 테슬라(TSLA) 일론 머스크, 선거 개입 논란 (16) | 2024.12.23 |

| 트럼프는 이미 전 세계에 충격파를 보내고 있다. (12) | 2024.12.23 |

| 테슬라(TSLA), K-배터리 실적 하향 전망 (98) | 2024.12.22 |

| 트럼프 "EU, 미국 석유·가스 구매 불응시 끝장 관세" (16) | 2024.12.21 |

| WTO 무역 분쟁과 중국 무역 전쟁이 기업 실적에 미칠 영향 (98) | 2024.12.21 |

| 미 11월 PCE 연방준비제도(Fed) 기조 뒤집을 정도는 아냐 (14) | 2024.12.21 |